UAE Corporate Tax for ADGM Entities [PAST]

About the webinar

A popular topic among business owners in the UAE with companies incorporated within ADGM. This webinar is designed by TLB Business Advisory Services for Clara's customers and aims to clarify an understanding on Corporate Tax.

Here’s what will be covered

- Registration for Corporate Tax

- Small business relief and qualifying rules

- Qualifying and excluding activities for ADGM free zone entities

- Working examples for common ADGM entities

- Filing the Tax return

- How can Clara & TLB help you?

Discover more from Clara

ADGM SPV – Your essential guide

Setting up a company in ADGM, and specifically a Special Purpose Vehicle (SPV), is attractive for founders and investors. Founders benefit from the speed and simplicity that ADGM’s fully digitised incorporation process achieves, while investors are attracted by the investment flexibility and legal protections that ADGM’s strong regulatory environment provides.

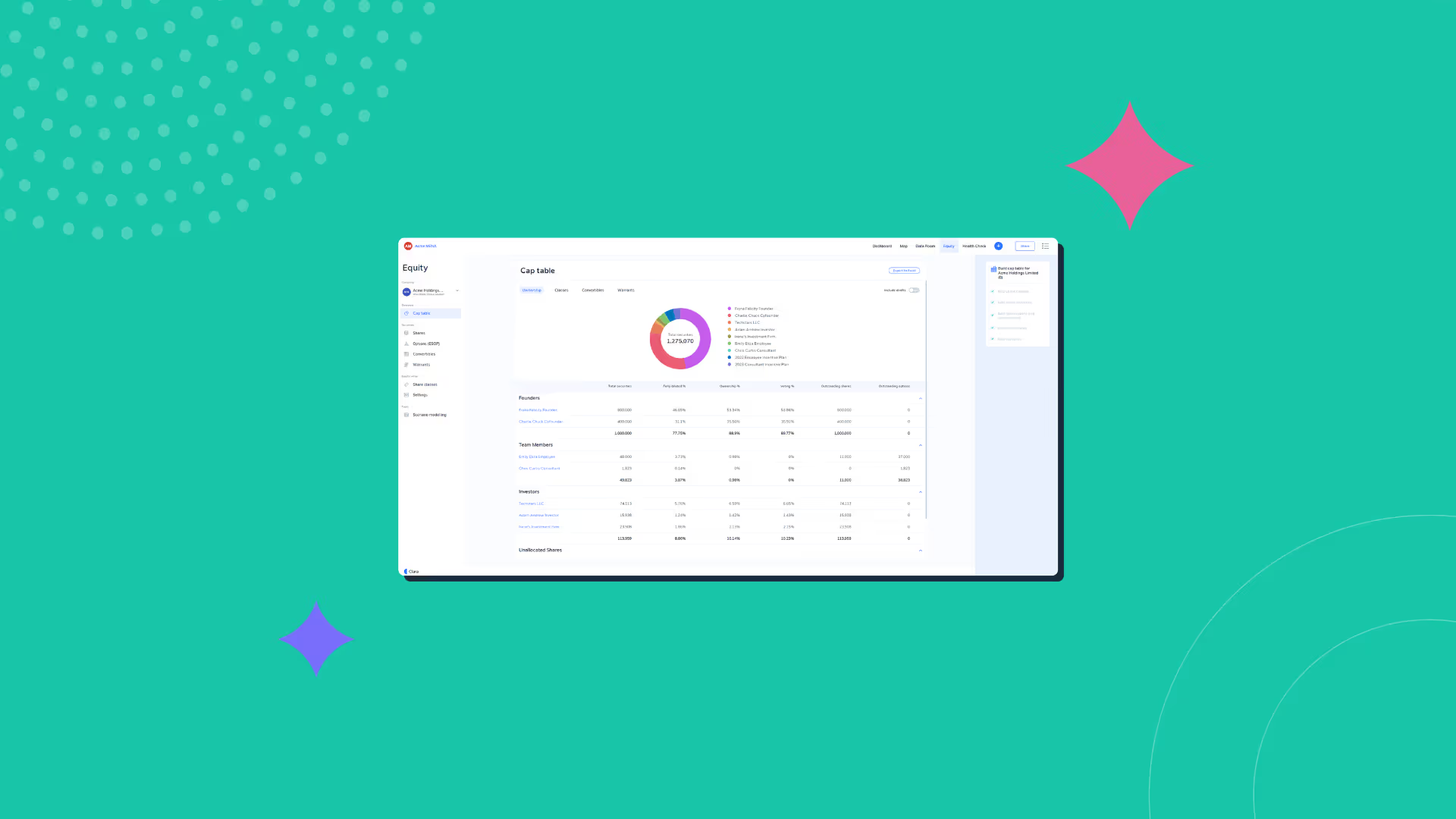

Cap tables explained

Whether you are looking to attract more investors or make key appointments for your start-up, you need a strong, up-to-date cap table. An accurate cap table gives potential investors the information they need to decide whether they will invest in your venture. It also helps stakeholders to keep track of their interests and shows potential employees what you can offer as stock options.

A guide to Founders Agreements

In the excitement and enthusiasm of starting a new business, formalising agreements are often overlooked. Startup founders are often friends or acquaintances, and it is easy to fall into the trap of only discussing roles, responsibilities, ownership structures and other important matters verbally. This can be dangerous.