Incorporation • Jurisdiction

The British Virgin Islands

Why choose the BVI?

The BVI is a well-known and widely trusted jurisdiction across the world

Business friendly environment

Trusted by leading companies, investors and lawyers around the world

BVI exempted company

Complete the form to receive an instant quote.

Journey

Process of digitally incorporating a BVI Exempted Company on Clara

Initial Information

01

/07

Nature of business

02

/07

Articles of Association

03

/07

Share capital

04

/07

Pay and Submit

05

/07

Review and Sign

06

/07

Track your progress

07

/07

Find out more about the exempted company license. Clara’s got you covered in BVI.

Benefits

Learn more about the benefits of BVI

A BVI exempted company can be incorporated with a minimum of one director and shareholder, and they do not need to be resident in the BVI.

The application process is done online, and all documents can be signed digitally on Clara. There is no requirement for any parties to be physically present in the BVI Islands for the incorporation process. The company is typically incorporated within 3 to 5 days.

The BVI Islands is a tax-neutral jurisdiction. There is currently no corporate, income, capital gains or any other tax on money earned outside the territory.

There is no minimum share capital and no maximum number of shares or shareholders. There is no restrictions on the nationality of the shareholders.

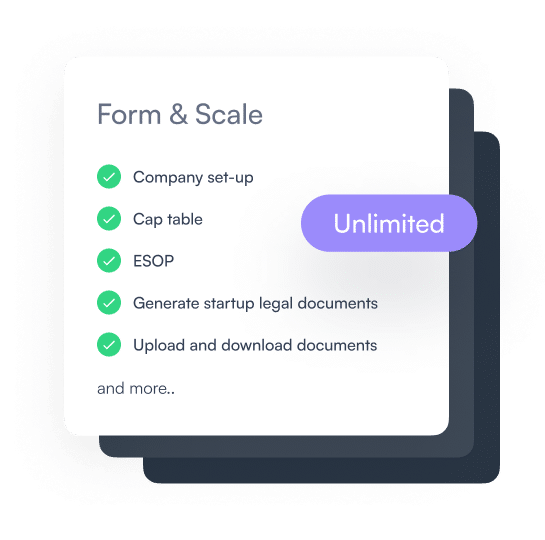

Clara bundles

Save up to $795 when you bundle your formation with our platform subscription

Resources & Insights

Stories, updates and resources

The anatomy of a Term Sheet

A term sheet is a relatively short document setting out the key terms of the investment agreed upon between the company and the investor in user-friendly language. It is also referred to as a Memorandum of Understanding (MOU). It includes the business and finance terms and could include legal terms regarding confidentiality and dispute resolution.

Clara Money

Frequently asked questions

A Cayman Exempted Company can be used as a passive holding company or TopCo that holds shares in operating companies. A Cayman Exempted company should not be used for active commercial activities. You should not employee people from your Cayman company, this should happen at the operating company level instead.

You will need to tell us the purpose of the SPV, its proposed name, who will be the shareholder(s), director(s) and authorised signatory and provide their identification information and documents. For a full list so you can start preparing now, click here.

No, the Cayman Islands is a tax-free jurisdiction. You will not need to pay company, individual, or capital gains tax.

A Cayman Exempted Company has annual, and event driven obligations. The annual obligations include and filing an economic substance declaration, paying the renewal fee and filing the annual return on or before the 31st of December. If changes occur to the company (such as a change of directors or shareholders), this will trigger a requirement to update the company books and / or the Registrar. For more information, click here.

Incorporating your Cayman Exempted Company can take approximately 5 – 7 days from submission to the Cayman registrar.

In order to speed up the process, be ready with up-to-date KYC for each shareholder and director. Corporate shareholders often take more time due to the requirement to collect KYC on the ultimate beneficial owners all the way up the group structure.

What are you waiting for?